Reporting on Demand Planning – Best Practices

The challenge of reporting is ubiquitous, irrespective of the sophistication of tools an organization employs. Either it takes too much time to put reports together, they lack context, or in some cases there are simply too many templates to choose from. With so much noise, what are the best practices?

The Challenges of Reporting Today

Time

In some organizations, planners spend up to eighty percent of their time aggregating information. Often times they will import a collation of data into Excel, create several pivot tables, and call it a report.

While there are some beautiful Excel reports out there, they come with challenges. The first and most obvious one is that far too much time is spent producing them. With all that time invested, the second challenge is particularly frustrating: Excel spreadsheets are error prone. In fact, a popular meta-analysis by Dr. Raymond R. Panko found that roughly 80% of spreadsheets contain error.

Templates

The alternative to Excel is to select from one of hundreds of pre-made templated reports. In theory, these greatly reduce the time spent pulling together information. The trouble is that templates end up being quite onerous to use. A planner that wants to pull various, specific data points for their S&OP meeting, is probably not going to make good use of templated reports. They are going to have to pull multiple different ones, and cobble together the pieces they need. That’s why planners end up using Excel.

Lack of Context

More often than not, reports lack context. Weighted MAPE is a good measure of forecast accuracy but it does not provide context of, for example, how hard a portfolio is to manage. Colleagues who aren’t doing forecasting every day may not understand how metrics like MAPE, wMAPE, and bias are calculated, or even what they mean. More concerning, people don’t know what good accuracy is to begin with.

“Without context, data is meaningless”

Often, other stakeholders of the company will say “Couldn’t this accuracy be better? Shouldn’t it be?” All else equal, maybe the accuracy should be better, but there are factors and events outside the control of the folks generating the forecasts that can have a serious impact on the numbers.

One example would be a customer moving a limited time offer promotion scheduled for the last week of December, because something happened on their end and it ends up taking place mid-January instead. That can really throw off the accuracy numbers for both months if they are being measured monthly at Lag 2. December actuals will be a lot lower than forecasted, and January will be much higher through no fault of the demand planner.

CHANGING THE CONVERSATION (with metrics)

Forecast accuracy improvements are a never-ending battle for marginal gains. 100% forecast accuracy will never be possible. Forecasts by their very nature will always be wrong. What is important is whether they are useful and the time spent producing them is appropriate to the business benefit being derived. Change the conversation.

Switch the focus from the accuracy and mistakes made, to error reduction and the mistakes avoided. The value that a demand planner brings to the table is quantifiable by using the metric Forecast Value Add (FVA). FVA is defined as the change in a forecasting performance metric that can be attributed to a particular step or participant in the forecasting process. It can be expressed as any metric, including wMAPE, forecast accuracy, or bias.

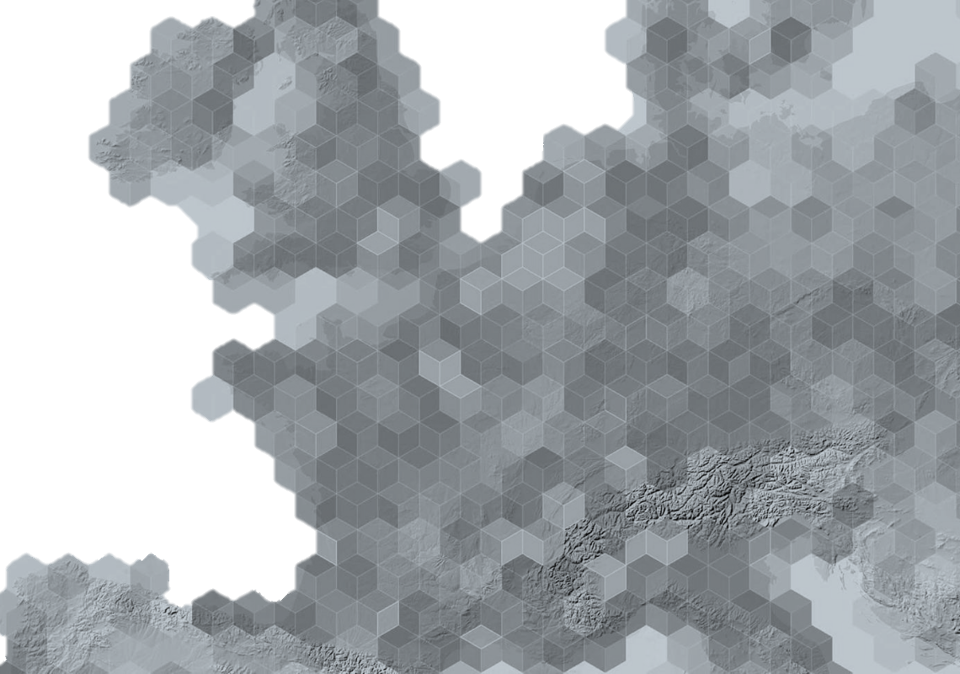

Fig. 1: FVA Absolute Error (Consensus over Baseline) Segmented by Volume and Forecastability

3 Best Practices

Personalized Planner Reports & Segmentation

When there is more than one planner managing a division, category, or material pricing group, understanding individuals’ forecast performance can be tricky. The accuracy number reported is a mix of results and can hide better/worse performers.

Take for example a large food service portfolio with 2 planners, typical reporting would assess the KPIs for the division or category overall. To reveal individual performance, it is best to separate the SKUs each planner is responsible for, and put them in context of how hard these SKUs are to manage.

Understanding portfolio management difficulty can be done by segmentation based on volume and forecastability, broken into quadrants: high volume predictable, high volume unpredictable, low volume predictable, and low volume unpredictable (see Fig. 1). Having a segmented portfolio enables planners to largely manage by exception using prescriptive alerts.

Alerts

Alerts are nothing novel, most systems alert planners of particular SKUs that are underperforming. The problem is that there are usually too many to wrap your head around, causing alert blindness. One forecaster we work with told us that before switching systems, he had more alerts than SKUs under management. You would be correct in guessing that he stopped paying attention to the alerts.

As a rule of thumb, less is more. Alerts should be scored and prioritized by importance and urgency. Furthermore, they should provide details about the nature of the alert and offer prescriptive analytics on how to fix the issue. For example:

Fig. 2: Fiddlehead Technology alerts.

Focus on Long Term Performance

Most planners would say they want to see the moving average of the metrics being reported. Consider a three-month moving average that is reported each period. Focusing on longer-term performance instead of individual months helps identify a bad month vs a bad trend. Find the sweet spot for your company in terms of months to include in the moving average, as well as the lag and level you should be reporting at.

These are only a few of many challenges and best practices for reporting on demand planning. Making effective use of personalized planner reports, SKU segmentation, and alerting set the foundation for relevant and contextual metrics that change the conversation and improve understanding throughout the company.

What are your best practices? Join the conversation and comment below!

Author: Marcus Rogers

Like what you just read? Sign up for our news letter.

Our quarterly forecast for the future of supply chain, straight to your inbox.

[inbound_forms id=”form_296″ name=””]