Every Forecast Has A Story

Every customer and product that comprise a demand planner, sales rep, or category manager’s portfolio has a story. When portfolios are passed on, the stories are often left behind.

Take for instance a demand planner in the CPG industry with a few hundred SKUs under management, each with a few customers and distribution centres, that means they’ve got thousands of stories to remember. Over time it becomes difficult or impossible to remember all the events that affected the forecast, how particular promotions performed, or the causes of outliers. Unfortunately, the list of events and their nuances is long. At the highest level, it can be broken up into two genres: internal and external events.

This blog post will dig into which stories are worth remembering, why it is so important to document them, and how to do that.

PROBLEM

“Those who don’t remember history are doomed to repeat it.”

The problem is simple, there are numerous events that affect demand and they are rarely well documented. Some will occur regularly, while others are anomalies. Some have little impact on forecasting, while others skew forecasts dramatically. While S&OP professionals know it is in their best interest to record and reference these events, they are often too busy putting out the fire du jour.

Though this list is far from exhaustive, some of the internal events worth documenting are new business being added, business lost, changes in DC, recalls, promotions, products being shorted, and one product being replaced by another. Externally, there are extreme weather events, unfavourable news, competitor activity, and so on. When documented comprehensively, past events can be used as a proxy for future events.

Take for example a retail SKUs that is actively promoted. Understanding the exact metrics of past promotion performance results in understanding the likely lift of a similar promotion run in the future, with a relatively high degree of certainty.

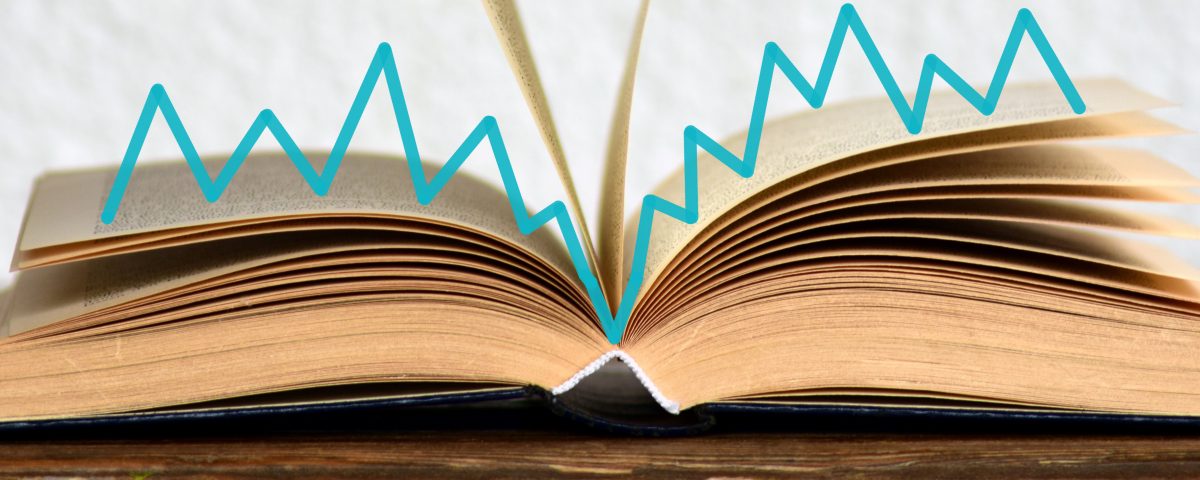

As for external events, consider the visualization below. It represents how tone changed in the media over time, with respect to bacon. Despite being something everyone loves, there are two distinct periods in the last three years when bacon had a strong negative sentiment in the news. Though they are separated by almost exactly one year, do not mistake them as seasonality. The first was surrounding all-time high prices, due to a shortage in supply, caused by the porcine epidemic diarrhea virus. The second, more significant dip, was not the result of the underlying economics, but rather the World Health Organization’s announcement that processed meats, like bacon, are potentially carcinogenic.

Media sentiment for bacon, produced using GDELT Analysis Service GKG (https://www.gdeltproject.org/).

For many processed meat producers, our clients included, the effects of events like the WHO announcement are surprisingly hard to map back to the root cause. Accounting for trend, seasonality, lag, consumer behaviour, shelf life, and a host of other factors makes a seemingly straightforward problem fairly complex.

WHY IT’S HARD TO SOLVE

Everyone knows this is a problem, so why is it so hard to solve?

It boils down to three components: team, technology, and time.

TEAM

Few products would make it to consumers if it weren’t for the collaborative, team effort that is the S&OP process. But there is a lot of room for improvement here. The trouble is people operate in functional silos, primarily concerned about their own responsibilities, and they don’t communicate well with other functional groups. As much as category manager Mel cares about demand planning Pat, when a product gets delisted with a particular customer, she has bigger fish to fry than informing him of this.

The worst case is someone leaving their role, taking with them all the stories that each forecast has to tell and leaving behind encrypted pages of adjusted numbers. Whoever comes in next will not know why adjustments were made, or if they’re still appropriate.

TECH

There is no catch-all tool to maintain documentation of events affecting demand. From binders with loose-leaf, to excel sheets, to ERP software, none do the job particularly well. Solutions today tend to be hard to share and are prone to error. The best case is having one central view for everyone to see all factors that impact a customer or product. While tools exist, we’ve yet to come across one that we, or any of our clients, are truly happy with.

TIME

There is no question, the long run benefits to documenting events are understood. The real question is if there is enough time in the day to document them. In the fast-paced CPG industry, plot twists are a regular part of the story. Understandably, pressing issues get prioritized, unfortunately at the cost of capturing history.

SOLUTION

At the end of the day, it doesn’t matter what kind of events are impacting demand. The more detailed documentation that can be done around what happened, the better the forecast can be in the future. Ideally, the documentation is a single source accessible to everyone on the S&OP team. Furthermore, it should be presented in an easy to understand manner that any team member can draw conclusions from and take action on. An effective such tool could be used to transfer knowledge to a new team member or to make better use of knowledge within the team itself.

“More than knowledge transfer, this is about knowledge management.”

Here at fiddlehead, we work with S&OP professionals from leading CPG companies every day. While we hear near-unanimous agreement surrounding everything outlined above, we have yet to come across a tool that is useful to this capacity. So, we’re building it. By working closely with soon-to-be end users, we believe we are building something uniquely useful.

If you work in S&OP and would like to help shape this tool, comment below or send us an email at hello@fiddlehead.io.

We are excited to share more in the near future!